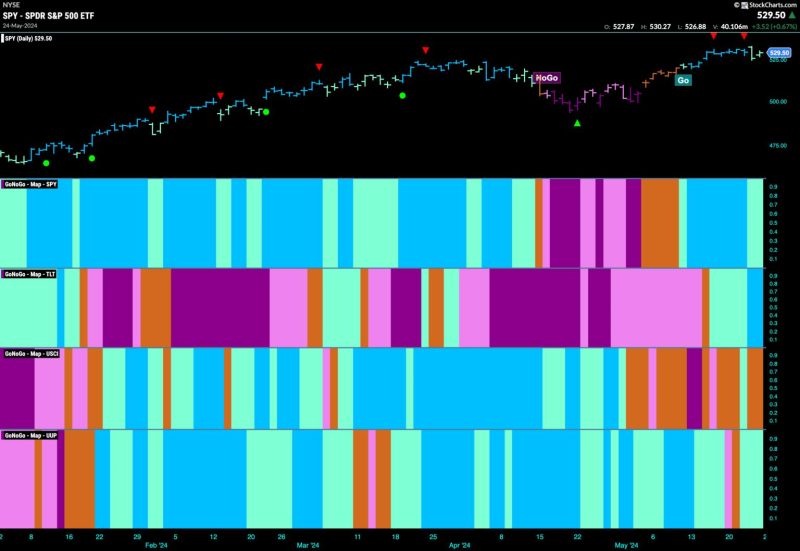

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

In the ever-evolving landscape of the stock market, the current trend of equities remains in the Go phase, showcasing promising opportunities for investors. However, the notable aspect of this trend lies in the sparse leadership exhibited by tech and utilities sectors, which have traditionally been the frontrunners in driving market performance.

Tech Sector’s Evolving Role in Equities

The tech sector, known for its innovation and disruption, has played a vital role in propelling equities upward in recent years. However, the sector’s leadership seems to be waning as other industries step up to the plate. This shift can be attributed to various factors, including regulatory scrutiny, concerns over data privacy, and market saturation in certain segments.

Despite these challenges, the tech sector remains a crucial component of the equities landscape, with companies like Apple, Microsoft, and Alphabet continuing to drive significant value for investors. The sector’s ability to adapt to changing market dynamics and capitalize on emerging trends will determine its future leadership in the equity markets.

Utilities Sector: A Cornerstone of Stability

In contrast to the tech sector, utilities have long been regarded as a stable and defensive investment option, offering consistent returns and dividend yields. While the sector may not garner the same level of excitement as tech stocks, its role in providing essential services such as electricity, water, and natural gas cannot be understated.

Utilities companies have weathered economic downturns and market volatility, making them a reliable choice for risk-averse investors seeking steady income streams. However, the sector’s limited growth prospects and regulatory challenges pose obstacles to its leadership in driving equity market performance.

Diversification and Asset Allocation

As investors navigate the complexities of the equity market, diversification and asset allocation play a critical role in managing risk and maximizing returns. By spreading investments across various sectors and asset classes, investors can mitigate exposure to sector-specific risks and capitalize on opportunities across the market.

While tech and utilities sectors continue to influence equities, investors should consider exploring other industries that show potential for growth and value creation. Emerging sectors such as renewable energy, healthcare, and consumer goods present exciting opportunities for investors seeking to diversify their portfolios and capture new market trends.

Looking Ahead: Navigating Uncertainty

As equities remain in the Go trend with sparse leadership from tech and utilities, investors are faced with navigating uncertainty and volatility in the market. Keeping a vigilant eye on market developments, staying informed about sector-specific trends, and maintaining a diversified portfolio will be key strategies for investors seeking to capitalize on market opportunities and mitigate risks.

In conclusion, while the tech and utilities sectors continue to play important roles in driving equity market performance, the evolving landscape of the stock market presents new opportunities and challenges for investors. By adopting a prudent investment approach, staying abreast of market trends, and diversifying their portfolios, investors can position themselves to thrive in the dynamic world of equities.