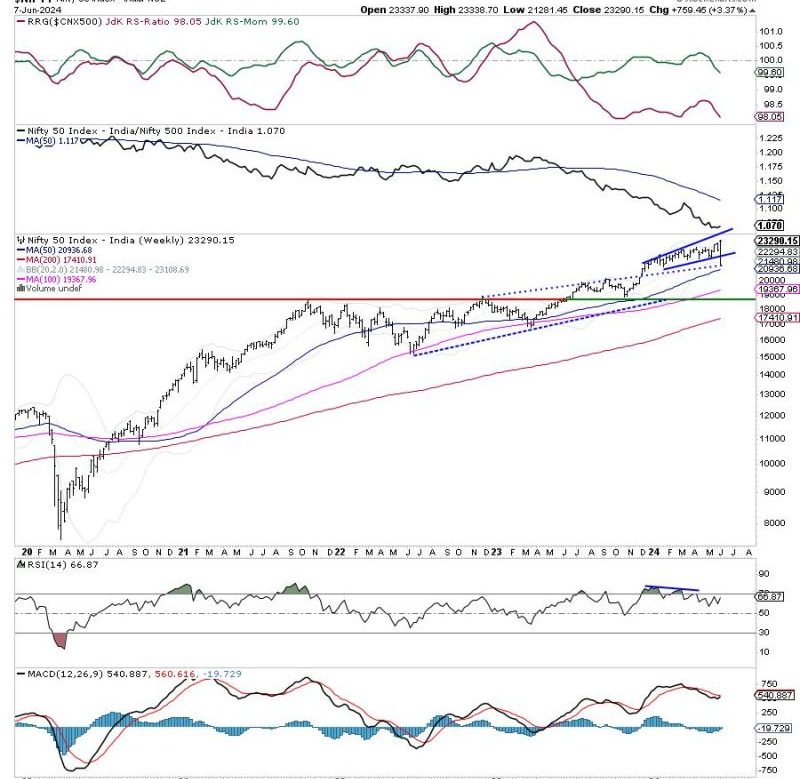

Throughout the past week, the Nifty 50 has experienced a pullback that has led to concern about market breadth and potential retracement. Despite some fluctuations in the market, the overall sentiment remains cautious as investors closely monitor various indicators to gauge the future direction of the market.

One of the key concerns among market participants is the lack of depth in the market breadth. While the Nifty has shown resilience in the face of various headwinds, there is a worrying trend of a limited number of stocks driving the index higher. This lack of widespread participation raises questions about the sustainability of the current market rally.

Another factor that adds to the apprehension is the potential for a retracement in the market. After a period of solid gains, a pullback is often seen as a natural course correction. However, the extent of this retracement and the level of support will be crucial in determining the overall health of the market. Market participants will be closely watching key levels and technical indicators to assess the likelihood of a significant pullback.

Despite these concerns, there are also positive developments that provide some hope for market stability. The global economic recovery, along with the progress in vaccination efforts, continues to support investor sentiment. Additionally, corporate earnings have been robust, reflecting the underlying strength of businesses even in challenging times.

As we look ahead to the coming weeks, it will be essential for investors to exercise caution and remain vigilant in their market analysis. Monitoring key technical levels, market breadth, and macroeconomic indicators will be crucial in navigating the potential risks and opportunities in the market.

In conclusion, while the recent pullback in the Nifty has raised concerns about market breadth and the possibility of retracement, there are also positive factors at play that provide some optimism. By staying informed and adopting a balanced approach to risk management, investors can better position themselves to navigate the uncertainties and opportunities that lie ahead in the market.