Watch Out: NIFTY Expected to Remain Calm With Defensive Strategies in Focus Next Week

The upcoming week for the Nifty may reflect a subdued trend as the market navigates through a truncated week schedule. With investors likely to adopt a cautious stance amidst global uncertainties, defensive plays could become a prominent strategy. Here, we delve into key insights for the week ahead.

Market Outlook:

The shortened trading week due to scheduled holidays poses a challenge for traders and investors to establish significant trends. Volatility might be limited, and volumes could experience a decrease as market participants adjust their positions according to the calendar. Amidst this backdrop, the Nifty might exhibit range-bound movement, offering limited opportunities for aggressive trading strategies.

Defensive Sector Performance:

Given the prevailing global economic landscape and uncertainties surrounding the market, defensive sectors such as pharma, FMCG, and IT could witness increased interest from investors. These sectors are known for their resilience during economic downturns and could offer stability and potential returns during uncertain times. Traders may consider allocating a portion of their portfolio to defensive stocks as a hedge against market turbulence.

Macro-Economic Factors:

Global cues, geopolitical developments, and domestic economic indicators are expected to influence market sentiment in the coming week. Factors such as inflation data, monetary policy decisions, and corporate earnings announcements could sway investor confidence and drive market movements. Traders are advised to stay updated on relevant news and events to make informed decisions in a rapidly changing market environment.

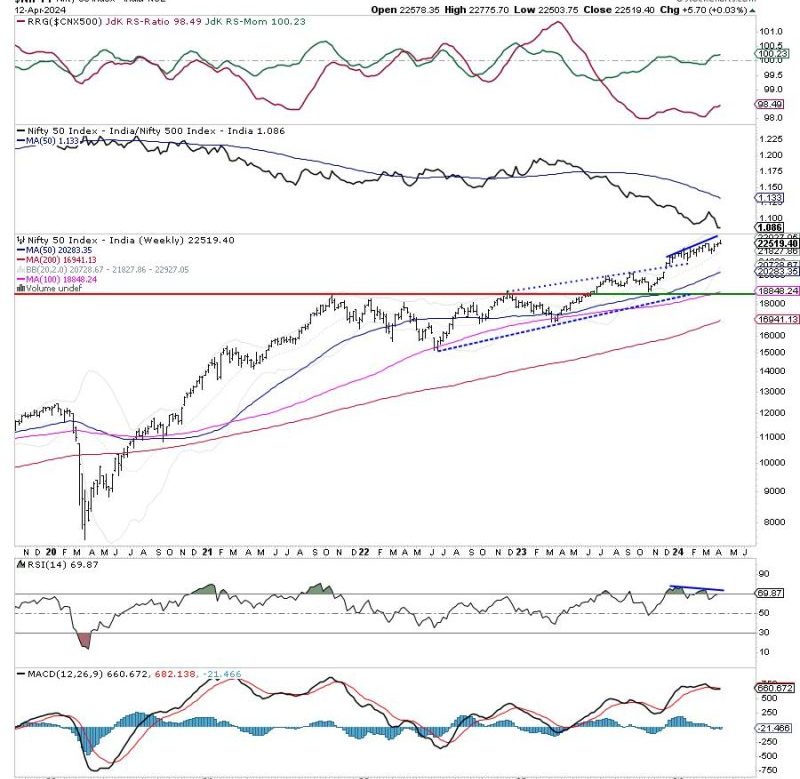

Technical Analysis:

Technical indicators and chart patterns can provide valuable insights into potential price movements and trend reversals. Traders may consider using tools such as moving averages, RSI, MACD, and chart patterns to identify entry and exit points for their trades. Additionally, keeping an eye on key support and resistance levels can help traders gauge the strength of a trend and adjust their positions accordingly.

Risk Management Strategies:

In a subdued market environment, risk management becomes crucial for traders to protect their capital and minimize losses. Setting stop-loss orders, diversifying the portfolio, and avoiding over-leveraging are essential risk management practices that traders should adhere to. By implementing effective risk management strategies, traders can safeguard their investments and preserve capital in volatile market conditions.

In conclusion, the upcoming week in the Nifty is likely to remain subdued due to the truncated trading schedule and global uncertainties. Defensive plays in sectors such as pharma, FMCG, and IT could offer stability and potential returns amidst market volatility. Traders are advised to stay vigilant, adopt risk management strategies, and remain informed about market developments to navigate through the challenges and capitalize on opportunities in the week ahead.