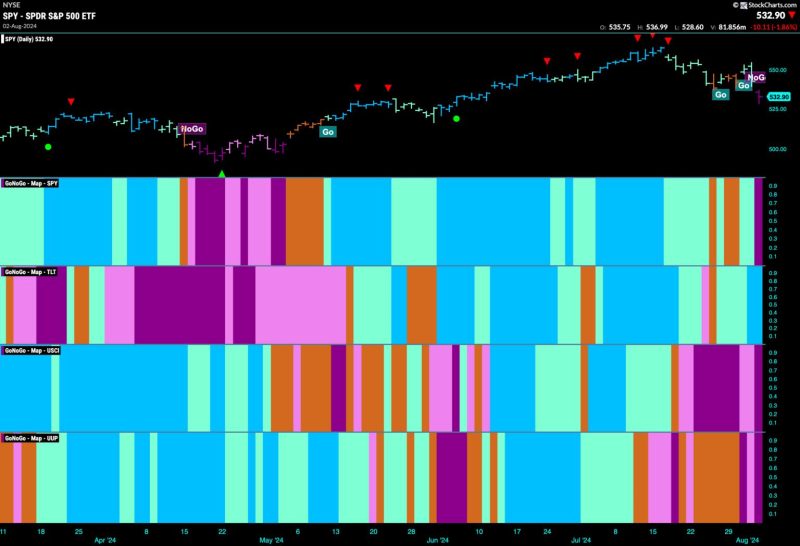

Stocks Get Defensive as Market Index Enters No-Go

The recent shifts in the stock market have raised concerns among investors, prompting a move towards defensive stocks as a safer bet amidst the volatility. Defensive stocks are typically those of companies that are known for their stability, reliable earnings, and dividends, making them resilient during economic downturns.

One of the key reasons for this defensive stance is the current uncertainty surrounding the market index, which has entered what some analysts are calling a no-go zone. This term refers to a situation where the market index is neither showing clear signs of growth nor steep decline, creating a sense of stagnation that can be unsettling for investors.

The defensive strategy involves shifting investments towards sectors that are considered less volatile and more likely to weather market fluctuations. These sectors often include utilities, healthcare, consumer staples, and telecommunications, among others. Companies in these sectors tend to have consistent demand for their products and services, making them less susceptible to changes in the economy.

Investors are also turning to defensive stocks as a way to protect their portfolios from potential downturns. By diversifying their investments and including defensive stocks in their portfolios, investors can reduce the overall risk exposure and potentially mitigate losses during turbulent times in the market.

In addition to their stability, defensive stocks also offer attractive dividend yields that can provide investors with a steady income stream, regardless of market conditions. This income can be particularly beneficial during periods of market uncertainty when capital appreciation may be limited.

While defensive stocks may not offer the same level of growth potential as more aggressive investments, they can play a crucial role in maintaining a balanced portfolio and minimizing risk. By strategically incorporating defensive stocks into their investment strategy, investors can navigate the current market environment with greater confidence and peace of mind.

In conclusion, the recent shift towards defensive stocks reflects investors’ cautious approach in response to the uncertain market index. By focusing on stable companies with reliable earnings and dividends, investors can build a more resilient portfolio that is better positioned to withstand market fluctuations. Ultimately, the defensive strategy offers a prudent way to protect investments and navigate challenging market conditions.