Market sentiment indicators play a crucial role in understanding the underlying sentiment of investors and traders towards the market direction. By analyzing these indicators, market participants can gauge the prevailing mood and make informed decisions regarding their investments. In the current market scenario, three key sentiment indicators are confirming a bearish phase, signaling a potential downturn in the near future.

The first indicator that suggests a bearish sentiment is the put/call ratio. This ratio compares the number of put options (which bet on a stock’s decline) to call options (which bet on a stock’s rise) traded on a particular stock or overall market. A rising put/call ratio indicates that investors are becoming more bearish and are buying more put options as a hedge against potential market declines. A high put/call ratio is often seen as a contrarian indicator, suggesting that too many investors are betting on a market downturn, which could lead to a short-term bounce or reversal.

Another important sentiment indicator is the Investors Intelligence survey, which polls various market newsletters and advisors to determine their bullish or bearish outlook on the market. When a high percentage of surveyed advisors are bullish, it may signal excessive optimism and a potential market top. Conversely, a surge in bearish sentiment among advisors could indicate a more cautious or negative market sentiment. In the current scenario, if the survey shows a significant increase in bearish sentiment, it could be a warning sign of an impending market correction or downturn.

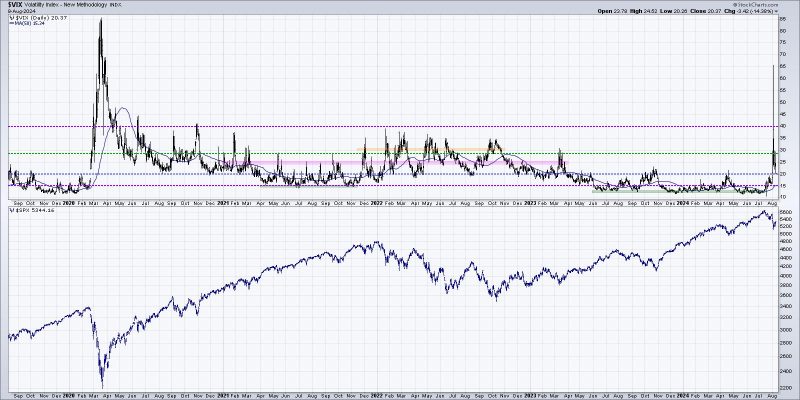

The third indicator confirming the bearish phase is the VIX, also known as the fear index. The VIX measures market volatility and investor expectations of large price swings over the next 30 days. A rising VIX often corresponds with a declining stock market, as higher volatility usually indicates increased fear and uncertainty among investors. If the VIX spikes sharply, it could suggest that investors are becoming increasingly cautious and hedging against potential market declines. A persistently high VIX level might indicate a prolonged period of market turbulence and downside risk.

In conclusion, monitoring market sentiment indicators is essential for investors to stay ahead of potential market movements and adjust their investment strategies accordingly. The combination of the put/call ratio, Investors Intelligence survey, and VIX provides valuable insights into the prevailing sentiment and helps investors navigate and manage risks in uncertain market conditions. By paying attention to these indicators and interpreting them in context, investors can make more informed decisions and potentially avoid significant losses during bearish market phases.