Anticipating a Week of Mild Pullbacks: NIFTY Faces Selling Pressure at Higher Levels

As forecasted on Godzilla Newz, the week ahead may see mild technical pullbacks, potentially impacting the Nifty as it remains susceptible to selling pressure at higher levels. The market’s performance hinges on several factors that could influence trading patterns in the coming days.

One significant determinant is the ongoing geopolitical tensions that have the ability to sway investor sentiment. With uncertainties looming on the global stage, market participants remain cautious, ready to react swiftly to any developments that might impact financial markets.

Moreover, domestic economic indicators such as GDP growth, inflation rates, and industrial output data will be closely monitored by analysts for insights into the country’s economic health. Positive numbers could reinforce market confidence and encourage buying activity, while disappointing figures might trigger profit-taking and weaken market sentiment.

Another crucial aspect to consider is the movement of foreign institutional investors (FIIs) in the Indian markets. Their buying or selling activity can significantly influence market trends, particularly in terms of liquidity and overall market direction. Monitoring FIIs’ behavior will provide valuable insights into market dynamics and help anticipate potential market movements.

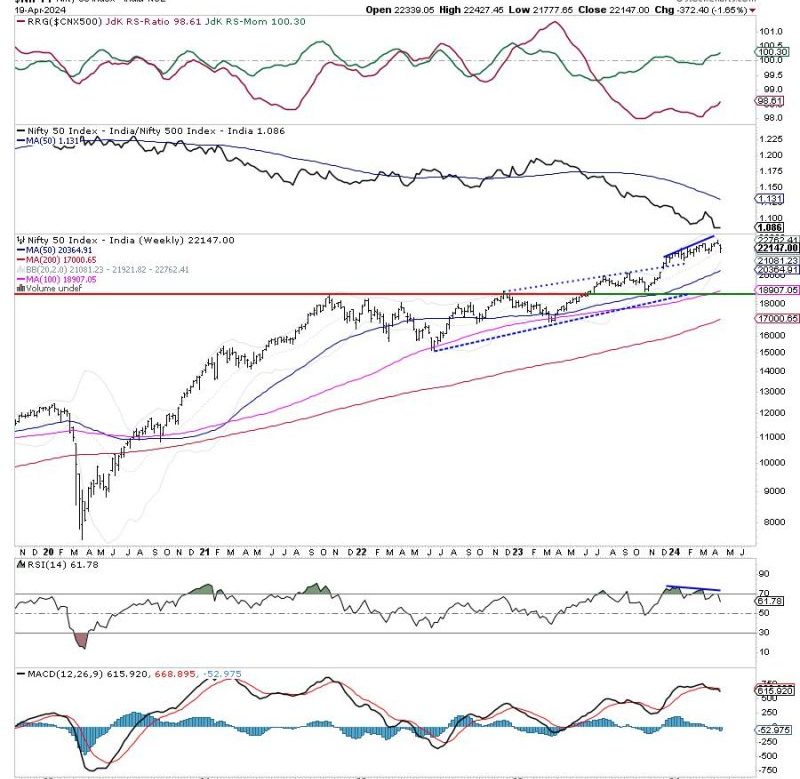

Technical factors such as support and resistance levels, moving averages, and trading volume will also play a pivotal role in shaping market movements. Traders and investors will closely watch these indicators to gauge market sentiment and identify potential trading opportunities.

Overall, the week ahead is likely to be characterized by a mix of bullish and bearish tendencies, with the market oscillating between minor corrections and periods of consolidation. It is essential for market participants to stay informed, stay vigilant, and adapt their trading strategies accordingly to navigate the market volatility and capitalize on emerging opportunities.