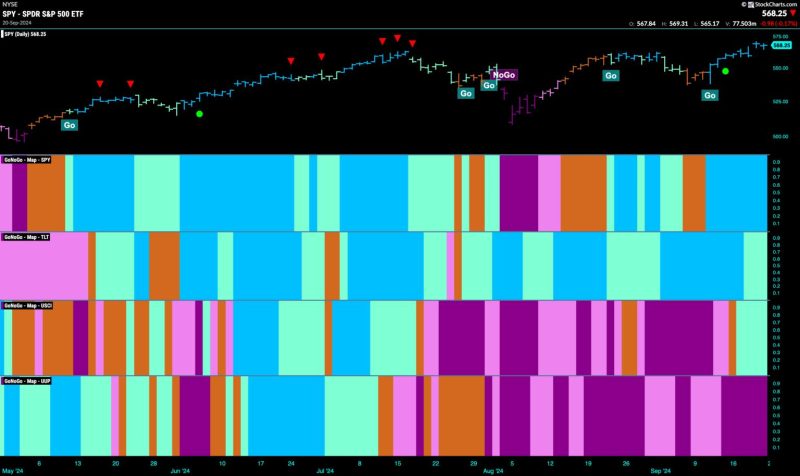

Equities Remain in Strong Go Trend Powered by Financials

The financial sector has been a driving force behind the sustained bullish trend in equities. Companies within this sector have shown resilience and adaptability in the face of challenges posed by the changing economic landscape.

One key factor contributing to the strong performance of financial equities is the industry’s ability to innovate and evolve in response to market conditions. Firms have embraced technological advancements, such as artificial intelligence and blockchain, to streamline operations and offer more efficient services to clients. This forward-thinking approach has enabled financial institutions to stay competitive and capture new opportunities for growth.

Furthermore, regulatory changes have also played a significant role in shaping the financial landscape. Reforms aimed at improving transparency and accountability have bolstered investor confidence in the sector, driving up demand for financial equities. This regulatory environment has encouraged companies to demonstrate good governance practices and adhere to stringent compliance standards, creating a more stable and secure investment environment.

The performance of financial equities is closely tied to broader economic indicators, such as interest rates and inflation rates. The Federal Reserve’s monetary policy decisions, including interest rate adjustments, have a direct impact on the profitability of financial institutions. In a low-interest-rate environment, financial firms may face margin pressures, but they can also benefit from increased borrowing and lending activity. By closely monitoring macroeconomic trends and adjusting their strategies accordingly, financial companies can navigate market uncertainties and maintain profitability.

Investors looking to capitalize on the strong go trend in financial equities should adopt a diversified approach to their investment portfolios. By spreading their investments across different subsectors within the financial industry, such as banking, insurance, and asset management, investors can mitigate risk and maximize returns. It is also important to conduct thorough research and due diligence before making investment decisions, taking into account factors such as company performance, valuation metrics, and growth prospects.

In conclusion, financial equities continue to exhibit a strong go trend driven by factors such as technological innovation, regulatory changes, and macroeconomic conditions. Investors can capitalize on this trend by adopting a diversified investment approach and staying informed about key developments within the financial sector. By carefully selecting financial investments and monitoring market dynamics, investors can position themselves to benefit from the sector’s continued growth and capitalize on emerging opportunities.