Unlocking the Potential: Your Ultimate Guide to Investing in Chromium Stocks (2024 Edition)

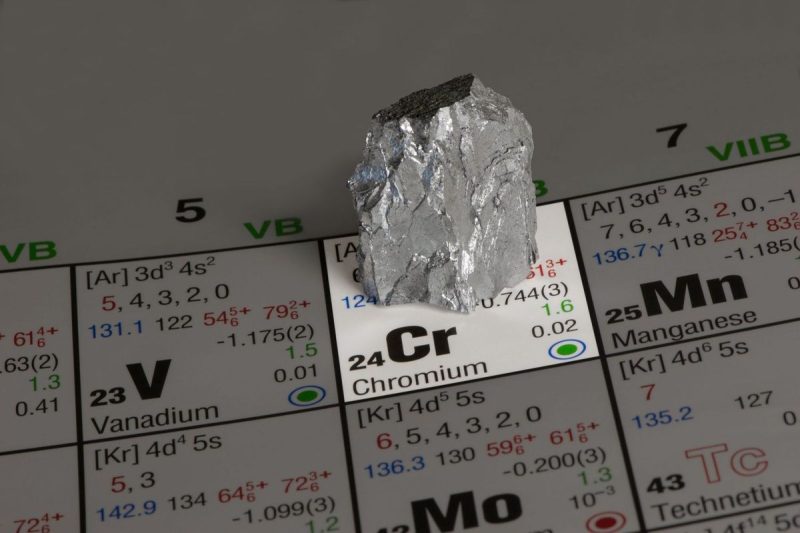

Investing in chromium stocks can be a lucrative opportunity for those looking to diversify their investment portfolio and tap into the growing demand for this essential metal. Chromium, commonly used in industries such as stainless steel production, aerospace, and automotive sectors, plays a vital role in various applications, making it a valuable commodity for investors.

Before diving into chromium stocks, it is essential to understand the market dynamics and factors that influence the chromium industry. Global demand for chromium is steadily increasing due to its corrosion resistance properties, which are essential in the manufacturing of stainless steel. As industries continue to expand and innovate, the demand for chromium is expected to rise, presenting a compelling investment opportunity.

When considering investing in chromium stocks, it is crucial to conduct thorough research on the companies operating in this sector. Look for established companies with a strong track record of production and growth in the chromium market. Companies with diversified operations and exposure to multiple industries that use chromium can provide added stability to your investment portfolio.

Additionally, keep an eye on market trends and the geopolitical landscape, as these factors can have a significant impact on the price of chromium stocks. Supply chain disruptions, trade policies, and economic conditions can all influence the value of chromium stocks, so staying informed and adapting your investment strategy accordingly is key.

One way to invest in chromium stocks is through exchange-traded funds (ETFs) that focus on companies involved in chromium production and utilization. ETFs offer diversification across multiple companies in the industry, reducing individual stock risk while still providing exposure to the sector’s potential growth.

Alternatively, investors can also consider direct investment in individual chromium mining companies. Conduct thorough due diligence on the financial health, production capacity, and growth prospects of these companies before making an investment decision. Look for companies with a solid management team, strategic vision, and a strong competitive position in the chromium market.

In conclusion, investing in chromium stocks can be a rewarding opportunity for investors seeking exposure to the growing demand for this essential metal. By understanding the market dynamics, conducting thorough research, and staying informed on industry trends, investors can make informed decisions and potentially benefit from the potential growth of the chromium sector. With careful consideration and a diversified approach, investing in chromium stocks can be a valuable addition to your investment portfolio.