Tin is a versatile and essential metal that plays a crucial role in various industries, from electronics to food packaging. As the demand for tin continues to rise, investing in tin stocks can be a lucrative opportunity for investors looking to diversify their portfolios. Here, we’ll explore key considerations and strategies for investing in tin stocks.

1. Understanding the Tin Market Dynamics

Before diving into tin stock investments, it’s essential to understand the market dynamics that influence tin prices. Tin is a relatively scarce metal, with limited global production compared to other industrial metals like copper and aluminum. As a result, factors such as supply disruptions, geopolitical tensions, and economic conditions can significantly impact tin prices.

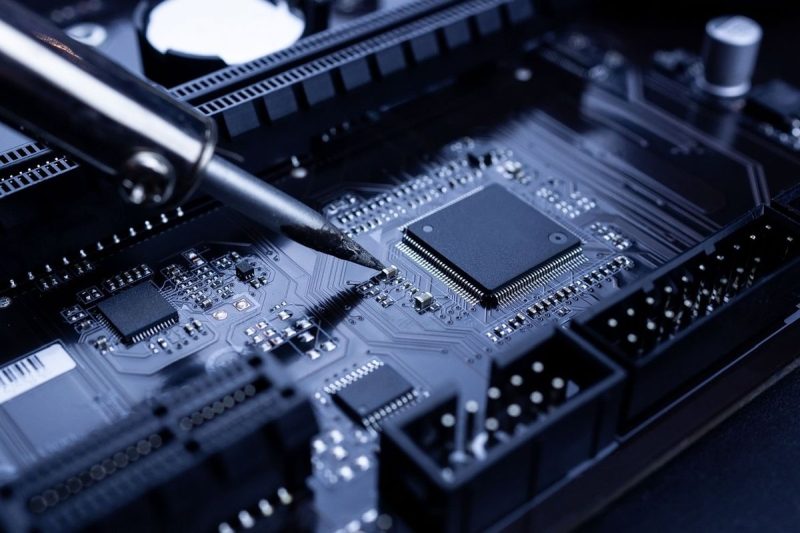

Additionally, tin is a critical component in various industries, including electronics, automotive, and construction. Rapid technological advancements, such as the rise of electric vehicles and renewable energy systems, are driving the demand for tin in key applications like soldering and batteries. Keeping abreast of these market trends and developments is crucial for making informed investment decisions.

2. Evaluating Tin Mining Companies

When considering investing in tin stocks, one of the key factors to assess is the performance and outlook of tin mining companies. Look for companies with strong track records in tin production, efficient operations, and strategic reserves. Companies that have diversified operations or are exploring new tin deposits may offer additional growth potential.

It’s also important to consider the geopolitical risks associated with tin mining operations, as disruptions in production can impact stock prices. Understanding a company’s exposure to geopolitical risks and its risk management strategies is essential for assessing its long-term viability as an investment.

3. Analyzing Tin Futures and Exchange-Traded Funds (ETFs)

For investors seeking exposure to tin prices without directly investing in mining companies, tin futures and exchange-traded funds (ETFs) can be alternative options. Tin futures contracts allow investors to speculate on the future price of tin, providing opportunities for short-term trading or hedging against price fluctuations.

ETFs that track the performance of tin prices or tin mining companies can offer a diversified and low-cost way to invest in the tin market. Before investing in tin futures or ETFs, it’s important to understand the risks associated with these financial instruments, including volatility and counterparty risks.

4. Diversifying Your Portfolio

As with any investment, diversification is key to managing risk and maximizing returns. Consider combining investments in tin stocks with other asset classes, such as stocks, bonds, or commodities, to create a well-rounded portfolio. Diversification can help mitigate the impact of market fluctuations on your overall investment portfolio.

Additionally, regularly reviewing and adjusting your investment strategy based on market conditions and your financial goals is crucial for long-term investment success. Keeping a close eye on tin market trends and seeking guidance from financial advisors can help you make informed decisions and optimize your investment portfolio.

In conclusion, investing in tin stocks can be a rewarding opportunity for investors looking to capitalize on the growing demand for this essential metal. By understanding the market dynamics, evaluating tin mining companies, analyzing tin futures and ETFs, and diversifying your portfolio, you can position yourself for success in the dynamic tin market. As with any investment, thorough research, careful planning, and ongoing monitoring are essential for achieving your investment objectives in the tin sector.