Debunking the False Equivalence: Student Loan Forgiveness vs. PPP Loans

Student Loan Forgiveness vs. PPP Loans: Understanding the Key Differences and Context

As the debate surrounding student loan forgiveness continues to intensify, particularly in the United States, comparisons have been drawn to other forms of governmental relief such as the Paycheck Protection Program (PPP) loans. While both these initiatives aim to provide financial support during challenging times, they operate within distinct contexts and serve different purposes. Thus, it is crucial to discern the fundamental differences between student loan forgiveness and PPP loans in order to evaluate their respective impacts accurately.

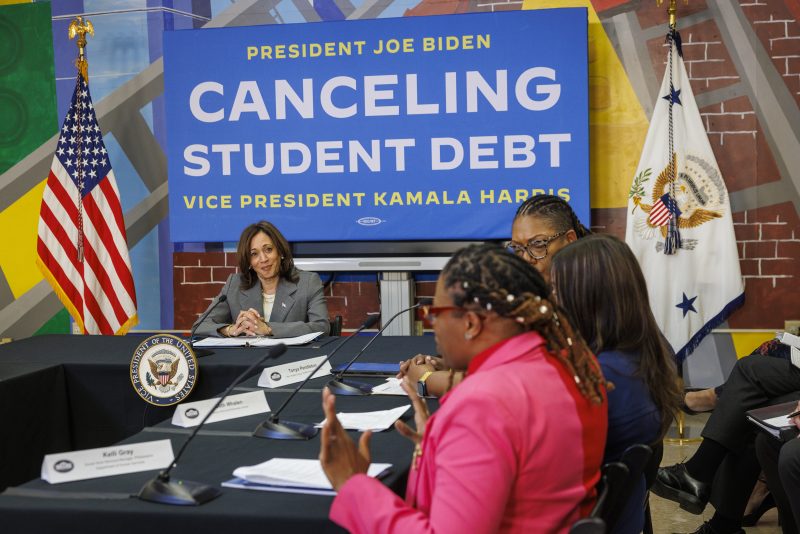

Student loan forgiveness programs, proposed as a measure to alleviate the burden of student debt, are primarily targeted at individuals who have borrowed money to finance their education. These programs advocate for the cancellation of part or all of a borrower’s outstanding student loan debt, aiming to relieve the financial strain on graduates and improve their economic well-being. The concept of student loan forgiveness is grounded in the recognition of the escalating cost of education and the resulting student debt crisis, with advocates arguing that burdening individuals with exorbitant debt limits their financial freedom and hampers their ability to contribute to the economy positively.

On the other hand, the PPP loans were introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in response to the economic fallout caused by the COVID-19 pandemic. The primary objective of the PPP loans was to provide financial assistance to small businesses affected by the pandemic, enabling them to retain their employees and sustain their operations. Unlike student loan forgiveness, which targets individuals, PPP loans focus on supporting businesses and preserving jobs during a period of economic uncertainty.

It is essential to recognize that the contexts in which these programs operate are vastly different. Student loan forgiveness addresses a long-standing issue of student debt accumulation, with a focus on individuals grappling with the consequences of high education costs. In contrast, PPP loans were a reactionary measure to mitigate the immediate impact of a global crisis on businesses and workers, underscoring the urgency and scale of the economic challenges faced during the pandemic.

Moreover, the financing mechanisms and consequences of these programs also diverge significantly. Student loan forgiveness entails a direct reduction or elimination of individual debt burdens, providing a tangible relief for borrowers. In contrast, PPP loans involve the distribution of funds to businesses, with the possibility of loan forgiveness contingent on meeting certain criteria such as maintaining payroll levels and adhering to specific spending guidelines. The repayment terms and scope of forgiveness differ between these initiatives, reflecting their distinct objectives and target beneficiaries.

In evaluating the effectiveness and equity of student loan forgiveness and PPP loans, it is crucial to consider these fundamental disparities in context, purpose, and implementation. While both initiatives aim to alleviate financial strain and promote economic stability, their approaches reflect the unique challenges and priorities of the circumstances they address. By understanding these differences, policymakers and stakeholders can make informed decisions about the design and implementation of financial relief measures that best address the needs of individuals and businesses in times of crisis and beyond.