Rules-Based Money Management: Measuring the Market

In the world of investing, managing money is an art that requires careful planning, disciplined decision-making, and a deep understanding of market dynamics. Rules-based money management is a strategy that aims to create a systematic approach to investing by setting clear guidelines and rules that dictate how capital should be allocated. In the second part of this series, we will explore the importance of measuring the market and how it can play a crucial role in successful money management strategies.

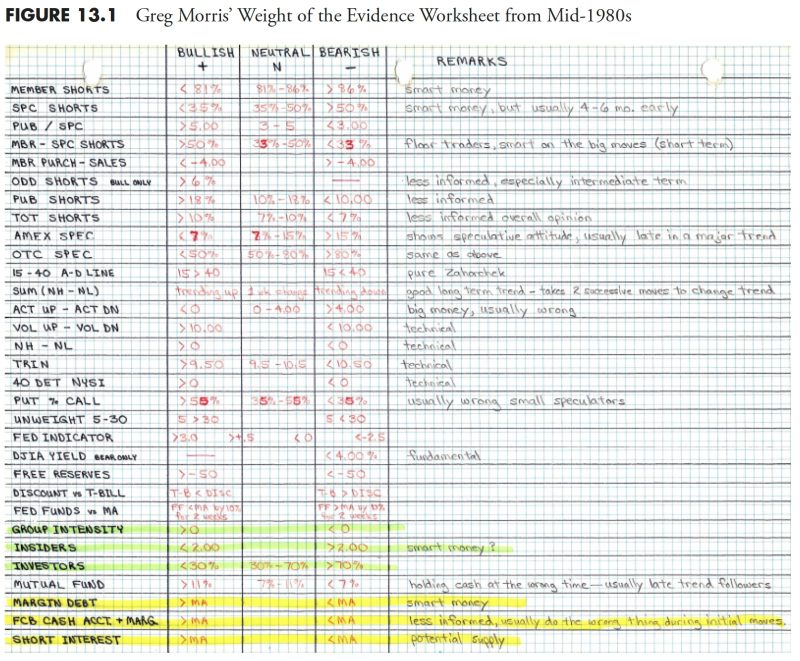

Market measurement is a fundamental aspect of rules-based money management as it provides investors with valuable insights into the current state of the market and helps them make informed decisions about their investment portfolios. There are various methods and indicators that can be used to measure the market, each offering unique perspectives and insights into different aspects of market behavior.

One popular method of measuring the market is through the use of technical analysis. Technical analysis involves studying past market data, such as price and volume, to identify patterns and trends that can help investors predict future market movements. By analyzing charts and graphs, investors can gain a better understanding of market sentiment and make more informed decisions about when to buy or sell securities.

Another important aspect of measuring the market is analyzing key economic indicators and market statistics. These indicators can provide investors with valuable information about the overall health of the economy and the financial markets. Indicators such as GDP growth, unemployment rates, inflation, and consumer confidence can all play a role in determining the direction of the market and can help investors gauge the level of risk in the market.

In addition to technical analysis and economic indicators, market sentiment is also an important factor to consider when measuring the market. Market sentiment refers to the overall attitude and emotions of investors towards a particular asset or market. By gauging market sentiment through tools such as sentiment indicators, investors can get a sense of how optimistic or pessimistic investors are and adjust their investment strategies accordingly.

One of the key benefits of measuring the market is that it allows investors to make informed decisions based on data and analysis rather than emotions or gut feelings. By having a clear understanding of market dynamics and trends, investors can avoid making impulsive decisions and stick to their predefined investment rules and strategies.

In conclusion, measuring the market is a crucial aspect of rules-based money management and plays a significant role in helping investors navigate the complex world of investing. By utilizing various methods and indicators to measure the market, investors can gain valuable insights into market behavior, make informed investment decisions, and ultimately improve their chances of achieving long-term financial success.