Certainly! Here is the body of the article for you:

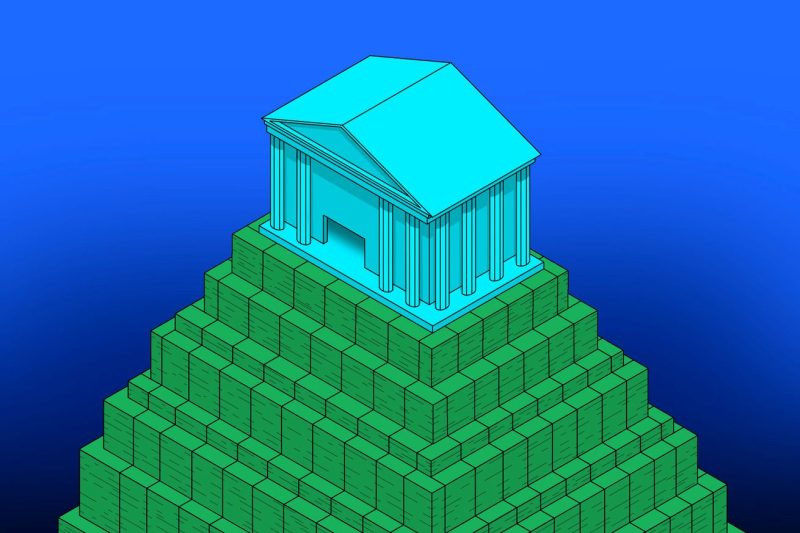

The IRS’s decision to extend its Free File tax program for an additional five years is a significant move that aims to benefit millions of taxpayers across the country. This program, which was initially created through a partnership between the IRS and leading tax software companies, allows eligible taxpayers to prepare and file their federal tax returns for free.

One key aspect of the Free File program is that it caters to taxpayers with different income levels. Individuals with an adjusted gross income of $72,000 or less can take advantage of this program to access free tax preparation services and electronic filing options. This not only helps taxpayers save money on tax preparation fees but also ensures greater accuracy in their tax filings.

Moreover, the Free File program offers a user-friendly online platform that simplifies the tax filing process for users. Taxpayers can navigate through the software easily, enter their tax information accurately, and file their tax returns securely. This digital platform also provides access to various tax forms and schedules, making it convenient for users to report their income, deductions, and credits.

By extending the Free File program for an additional five years, the IRS is demonstrating its commitment to promoting financial inclusivity and reducing barriers to tax compliance. This initiative is particularly beneficial for low and moderate-income taxpayers who may struggle to afford professional tax assistance. Through the Free File program, these taxpayers can fulfill their tax obligations without incurring additional costs, thereby contributing to a more equitable tax system.

Furthermore, the extension of the Free File program highlights the IRS’s recognition of the evolving landscape of tax preparation and filing. As technology continues to advance, digital solutions like the Free File program play a crucial role in modernizing the tax process and enhancing taxpayer experiences. By offering an online platform for free tax preparation, the IRS is leveraging technology to make tax compliance more accessible and efficient for taxpayers.

In conclusion, the IRS’s decision to extend the Free File tax program for five more years underscores the importance of providing free and user-friendly tax preparation services to taxpayers. This program not only empowers individuals to file their tax returns accurately and securely but also promotes financial inclusivity by catering to taxpayers with varying income levels. Through the Free File program, the IRS is fostering a more equitable tax system and embracing technological advancements to streamline the tax filing process.