The Hindenburg Omen Flashes Initial Sell Signal

The Hindenburg Omen, a technical analysis pattern named after the Hindenburg disaster of 1937, has recently flashed an initial sell signal. This occurrence has sparked concerns among investors and traders alike as it is often seen as a warning sign of potential market turbulence.

What is the Hindenburg Omen?

The Hindenburg Omen is a bearish technical indicator that is used to predict the likelihood of a stock market crash. It was developed by James R. Miekka and named after the Hindenburg disaster, which was a catastrophic event involving the crash of the German airship Hindenburg in New Jersey in 1937.

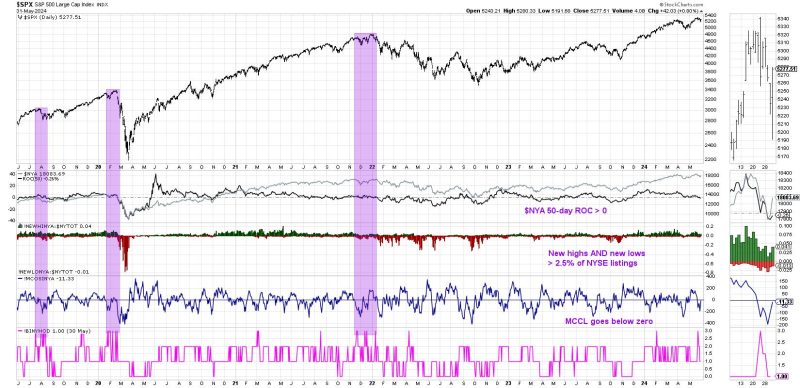

The indicator is calculated using a series of criteria that involve market breadth and price movement. Some of the key criteria include the number of stocks hitting new highs and new lows, as well as the overall movement of the stock market. When these criteria are met, it is considered a signal that the market is vulnerable to a downturn.

The Initial Sell Signal

The recent flashing of the initial sell signal of the Hindenburg Omen has raised alarm bells among market participants. This signal occurs when a set of criteria are met simultaneously, indicating a higher likelihood of a market correction. While the Hindenburg Omen is not infallible and has had false signals in the past, it is still taken seriously by many traders and analysts.

Market Reaction

Following the initial sell signal of the Hindenburg Omen, market participants have been closely monitoring the movement of key indices and individual stocks. The signal has created a sense of unease and uncertainty, leading to increased volatility in the market.

Investors are advised to exercise caution and closely monitor their portfolios during this period of uncertainty. While the Hindenburg Omen is just one indicator among many, its flashing of an initial sell signal should not be taken lightly.

Conclusion

In conclusion, the recent flashing of the initial sell signal of the Hindenburg Omen has put the spotlight on the potential for a market correction. While the indicator is not foolproof, it serves as a reminder for investors to stay vigilant and be prepared for potential turbulence in the market. As always, it is essential to conduct thorough research and seek advice from financial professionals before making any investment decisions during times of uncertainty.