Sector Rotation Model Flashes Warning Signals

The global financial markets are often a complex and unpredictable environment, with various factors influencing the flow of money and investments. In these dynamic landscapes, financial professionals and analysts employ various models and strategies to navigate through the seas of uncertainties and make informed decisions.

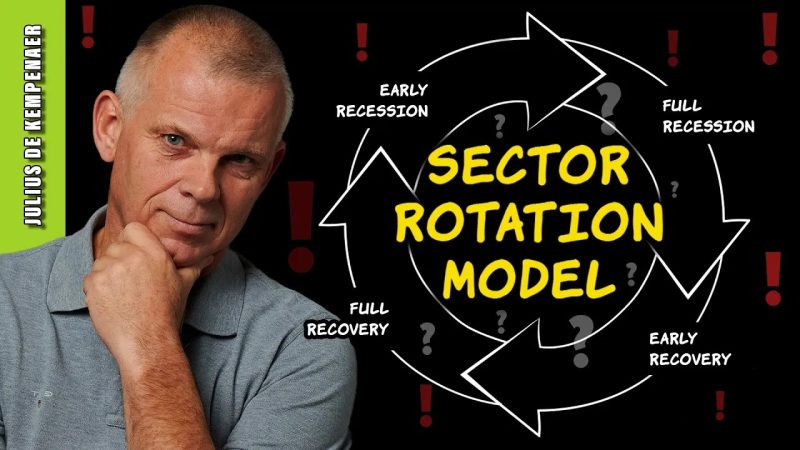

One such model that has gained popularity in recent years is the sector rotation model. This model revolves around the idea that different sectors of the economy perform better at different stages of the economic cycle. By identifying these stages and rotating investments accordingly, investors aim to capitalize on the prevailing market conditions.

However, no model is foolproof, and the sector rotation model is no exception. Recent developments in the market have raised concerns and flashing warning signals for investors relying solely on this model. It is crucial to analyze these warning signals and understand the limitations of the sector rotation model to make informed investment decisions.

One of the primary warning signals flashing in the sector rotation model is the impact of external factors on sector performance. While the model’s premise is based on the assumption that sectors outperform at different stages of the economic cycle, real-world events and external shocks can quickly disrupt this pattern. Recent examples include the COVID-19 pandemic, geopolitical tensions, and regulatory changes, all of which have significantly impacted sector performance.

Another warning signal to consider is the evolving nature of industries and sectors in the modern economy. Technological advancements, changing consumer preferences, and disruptive innovations can quickly reshape the competitive landscape, rendering traditional sector rotation strategies obsolete. Investors need to adapt to these changes and incorporate a more dynamic approach to sector allocation.

Additionally, the sector rotation model’s reliance on historical data and patterns poses a significant risk in today’s rapidly changing markets. Past performance may not always be indicative of future results, especially in a dynamic and interconnected global economy. Investors must supplement the sector rotation model with real-time data, qualitative analysis, and expert insights to mitigate risks and enhance decision-making.

Moreover, the growing interconnectedness of sectors and industries in the modern economy complicates the sector rotation model’s effectiveness. Cross-sector correlations and spillover effects can blur the boundaries between traditionally distinct sectors, making it challenging to isolate and capitalize on sector-specific trends.

In conclusion, while the sector rotation model offers a structured approach to sector allocation and investment decisions, investors must be cautious and aware of the warning signals flashing within this model. By analyzing external factors, adapting to industry trends, incorporating real-time data, and considering cross-sector dynamics, investors can navigate through the complexities of the market with a more informed and resilient investment strategy.