The article discusses the technical analysis of semiconductors, particularly focusing on the SMH ETF. Technical analysis is a method used by traders and investors to forecast the future price movements based on historical data. When examining a chart, traders look for patterns and trends that indicate potential price movements. One common pattern that traders watch for is called the double top.

A double top is a bearish reversal pattern that occurs after an uptrend. It is formed when the price reaches a peak, retraces, bounces back up to a similar level, and then fails to break through that level again. This creates a M shaped pattern on the chart. The double top pattern indicates that the uptrend is losing momentum, and a reversal to the downside may be imminent.

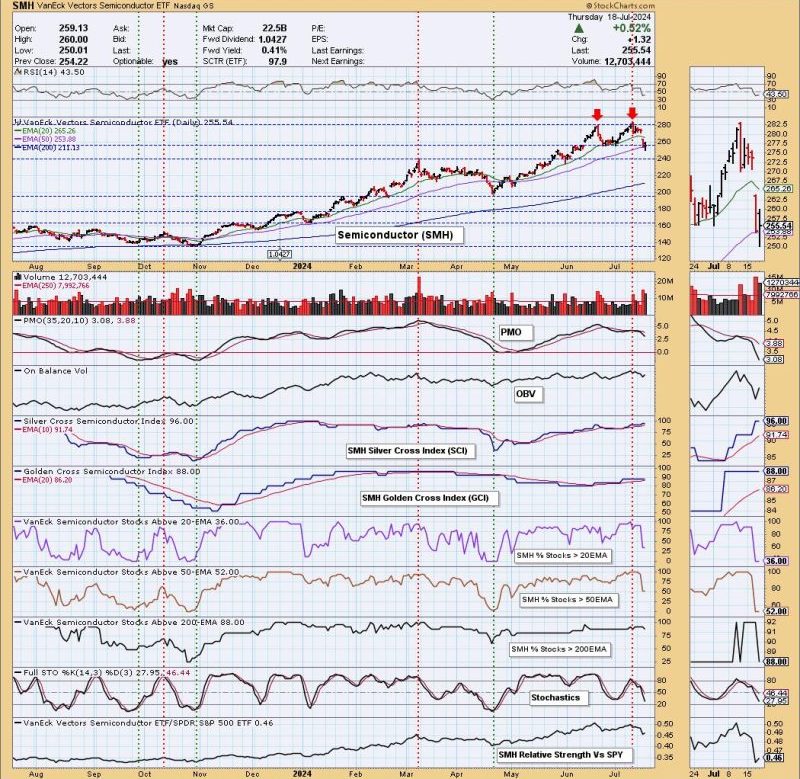

In the case of the SMH ETF, a double top pattern has been identified on the chart. The price reached a peak around $270, retraced, then rallied back up to near $270, forming the second peak. However, it failed to break through this level, indicating potential weakness in the uptrend. This could signal a reversal in the price direction, with a potential downward movement in the near future.

Traders who recognize the double top pattern may consider taking a bearish position, such as selling the asset short or buying put options, in anticipation of a price decline. It is important to note that technical analysis is not foolproof and should be used in conjunction with other forms of analysis and risk management strategies.

In conclusion, the double top pattern on the SMH ETF chart suggests a potential reversal in the uptrend and a bearish outlook for the near future. Traders and investors should closely monitor the price movement and consider appropriate risk management strategies when making trading decisions based on technical analysis patterns like the double top.