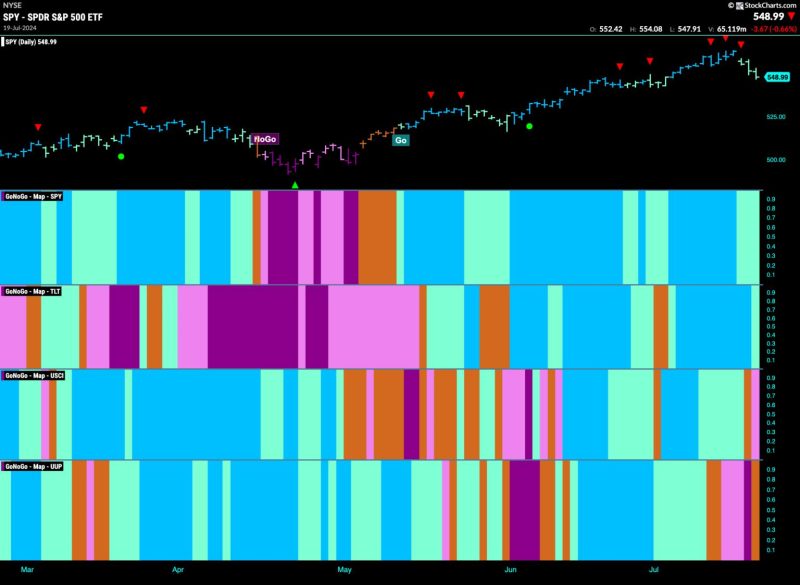

As referenced in the article on Godzilla Newz, there is a visible shift in the financial sector as equities start to falter, prompting a rise in attention towards financials. This transformation in market dynamics comes at a time of economic uncertainty and reflects investors’ cautious approach towards their portfolios.

One key aspect to consider is the performance of financial companies against equities. Historically, equities have been favored by investors seeking high returns, driven by the potentially rapid increases in stock prices. However, the recent trend weakening in equities has prompted a reevaluation of investment strategies, resulting in a growing interest in financials.

Financial companies have traditionally been perceived as more stable and less volatile than equities, making them an attractive option for risk-averse investors during uncertain market conditions. The increased focus on financials can be attributed to their ability to provide consistent returns and act as a hedge against market downturns.

Furthermore, the performance of financial companies is often closely tied to the overall health of the economy. As economic conditions continue to fluctuate, investors are turning to financials for potential growth and stability. This shift in focus indicates a more defensive approach to investing, with an emphasis on safeguarding capital and generating steady returns.

In conclusion, the recent outperformance of financials compared to equities reflects a broader trend in the market towards safer and more stable investments. As investors navigate through a challenging economic landscape, the resilience of financial companies is becoming increasingly attractive. By reevaluating their portfolios and considering the benefits of financials, investors can potentially mitigate risk and capitalize on opportunities for growth in the current market environment.