Navigate the Week Ahead: Navigating NIFTY’s Cautious Stance with Key Levels to Watch

In the realm of financial markets, the Nifty index continues to exhibit a cautious stance as a defensive setup begins to take shape. Anticipating market movements and understanding key levels is crucial for traders and investors alike. Let’s delve into the upcoming scenarios and crucial levels to watch out for.

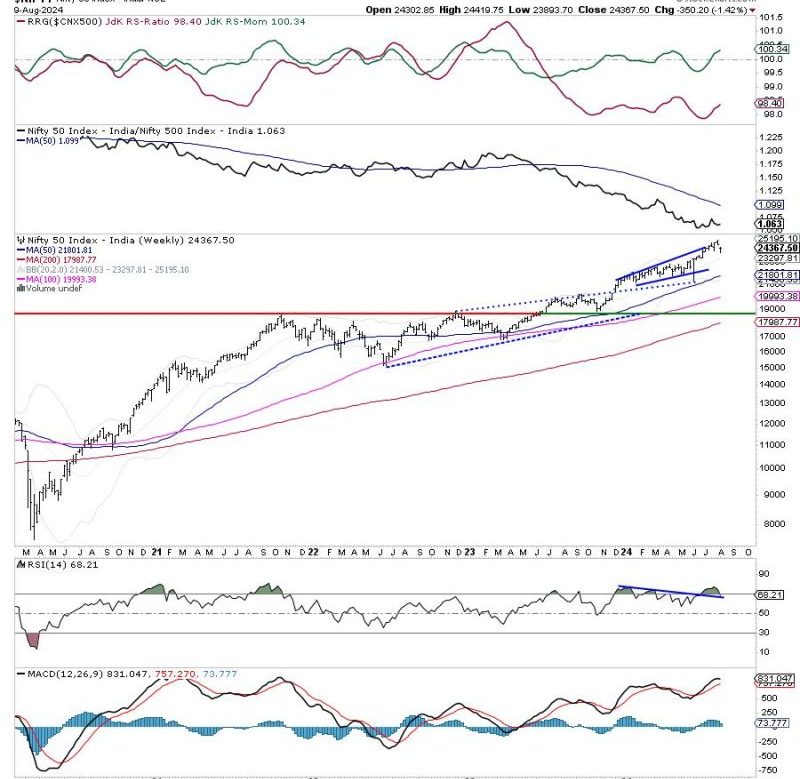

Technical analysis plays a pivotal role in gauging market sentiment and predicting potential price movements. Currently, the Nifty index appears to be experiencing a tentative phase, as reflected by the cautious trading behavior. Investors are advised to closely monitor the evolving market dynamics and adjust their strategies accordingly.

Key support and resistance levels serve as important markers for traders to formulate their entry and exit points. By paying close attention to these levels, investors can effectively manage risk and enhance their trading decisions. It is imperative to have a thorough understanding of these levels to navigate the market with confidence.

The development of a defensive setup suggests a shift in market sentiment towards a risk-averse approach. In such scenarios, investors often seek refuge in defensive sectors such as healthcare, utilities, and consumer staples. By allocating their investments strategically across different sectors, investors can mitigate risk and optimize their portfolio performance.

Market volatility is an inherent characteristic of financial markets, and traders must be prepared to navigate through turbulent times. Implementing risk management strategies such as stop-loss orders and diversification can help mitigate potential losses and safeguard investment capital. Maintaining a disciplined approach to trading is essential for long-term success in the markets.

In conclusion, the Nifty index is displaying a tentative stance as a defensive setup begins to emerge. By closely monitoring key support and resistance levels, investors can make informed trading decisions and navigate through market uncertainties. Implementing risk management strategies and staying abreast of market developments are crucial for success in the dynamic world of financial markets.