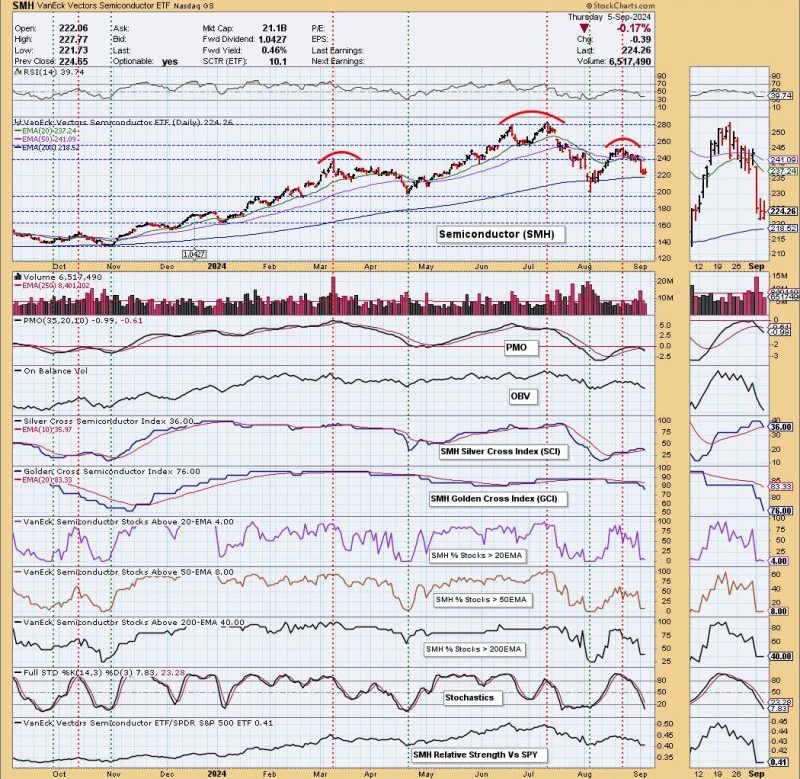

SMH: Spotting a Bearish Head & Shoulders Pattern for the Intermediate-Term

The semiconductor industry is a critical component of the modern world, providing the backbone for a wide range of technologies that we rely on every day. However, recent developments in the market suggest that the intermediate term outlook for semiconductor stocks may be bearish due to the formation of a head and shoulders pattern on the SMH chart.

The head and shoulders pattern is a technical analysis formation that is widely used by traders and investors to predict potential trend reversals in the market. This pattern consists of three peaks – the left shoulder, the head, and the right shoulder – with the middle peak (the head) being the highest. The formation of a head and shoulders pattern typically indicates a potential shift from an uptrend to a downtrend.

In the case of the semiconductor ETF SMH, the formation of a head and shoulders pattern suggests that the intermediate term outlook for semiconductor stocks may be bearish. The left shoulder of the pattern was formed in early 2021, followed by the head in mid-2021, and finally, the right shoulder in late 2021. The neckline of the pattern serves as a key level of support, and a breakdown below this level could signal further downside for semiconductor stocks.

Several factors may contribute to the bearish outlook for semiconductor stocks indicated by the head and shoulders pattern on the SMH chart. One of the key factors is the ongoing global semiconductor shortage, which has disrupted supply chains and led to increased costs for manufacturers. Additionally, rising inflation and higher interest rates could potentially weigh on semiconductor companies’ profitability, further dampening investor sentiment towards the sector.

Furthermore, geopolitical tensions and trade disputes between major economies, particularly the US and China, may also impact semiconductor stocks. These uncertainties could lead to increased volatility in the market, making it challenging for semiconductor companies to navigate the landscape effectively.

In conclusion, the formation of a head and shoulders pattern on the SMH chart suggests a bearish intermediate term outlook for semiconductor stocks. While the semiconductor industry remains essential for technological advancements, investors should exercise caution and monitor key support levels to assess the sustainability of the current uptrend. By staying informed and vigilant, investors can make more informed decisions to navigate the challenges and opportunities presented in the semiconductor sector.