Alert: NIFTY Signals Potential Uptrend Disruption Ahead; Exercise Caution

The article discusses how Nifty, the Indian stock market index, is showing early signs of a potential disruption in its uptrend. By analyzing technical indicators and market trends, the author warns investors to tread cautiously in the coming week.

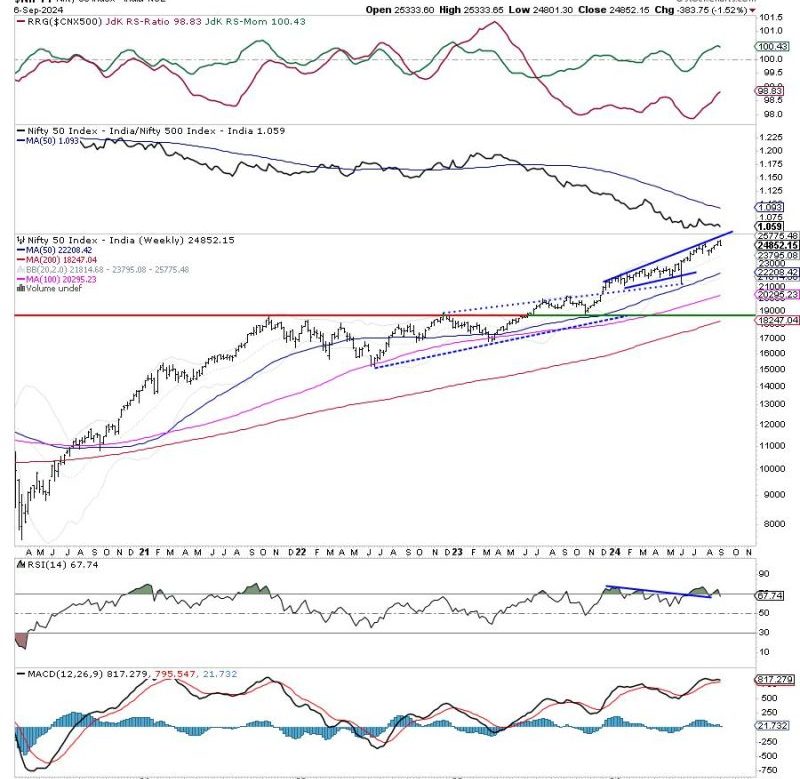

Starting off with the current market conditions, the article notes that Nifty has been trading near all-time highs, boosted by positive momentum from various sectors. However, a recent shift in market sentiment has raised concerns about a possible trend reversal. This change in sentiment is reflected in the divergence between price movement and key indicators like the Relative Strength Index (RSI) and Moving Averages.

The RSI, a commonly used momentum oscillator, has been indicating overbought conditions in the market, suggesting that a correction may be on the horizon. Additionally, the Moving Averages, a technical tool used to smooth out price data and identify trends, have shown signs of convergence, hinting at a potential loss of bullish momentum.

Furthermore, the article points out the importance of monitoring key support and resistance levels in the Nifty index. Any breach of these levels could signal a shift in market dynamics and potentially lead to increased volatility. Traders are advised to closely observe how Nifty reacts at these critical levels in the coming sessions to assess the strength of the prevailing trend.

In addition to technical indicators, the article also highlights external factors that could impact the market. Global economic conditions, geopolitical events, and monetary policy decisions by central banks are all potential triggers for market disruptions. Investors are urged to stay informed about these developments and adjust their trading strategies accordingly to manage risk effectively.

In conclusion, the article emphasizes the need for caution and vigilance in the current market environment. While the uptrend in Nifty has been strong, the early signs of a potential disruption serve as a warning for investors to exercise prudence in their decision-making. By staying alert to market signals and adapting to changing conditions, traders can better navigate the uncertainties ahead and protect their investments.