Unveiling the Mystery: Rate Cuts Impact on Stock Performance – Are You Bullish or Bearish?

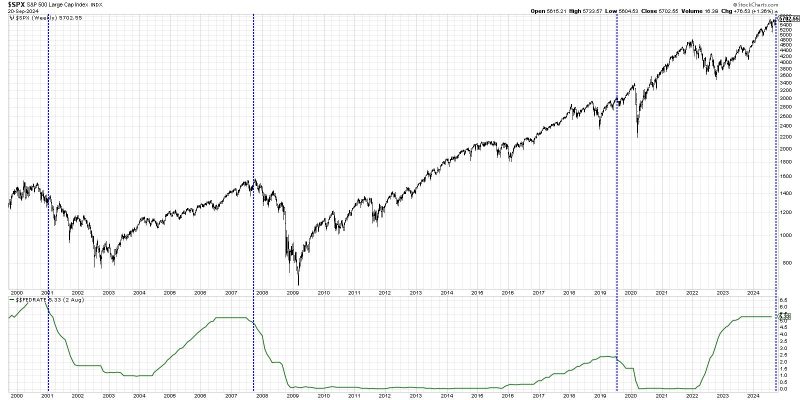

In recent years, the debate around rate cuts and their impact on stock performance has been a heavily discussed topic among investors and analysts alike. The central question that often arises is whether rate cuts by central banks signal a bullish or bearish outlook for stocks. While it is tempting to think of rate cuts as an unequivocally positive development for stock markets, the reality is far more nuanced.

Historically, central banks use rate cuts as a tool to stimulate economic growth by making borrowing cheaper and encouraging spending. Lower interest rates can potentially boost corporate profitability by reducing borrowing costs and increasing consumer spending, which in turn can lift stock prices. This optimistic view suggests that rate cuts can be a bullish signal for stocks, leading to increased investor confidence and market performance.

However, it is essential to consider the broader economic context in which rate cuts occur. In many cases, central banks lower interest rates in response to economic slowdowns or financial crises, signaling underlying weaknesses in the economy. These adverse conditions can outweigh the positive effects of rate cuts on stocks, leading to a bearish outlook for market performance.

Investors should also be aware of the diminishing returns of rate cuts over time. As interest rates approach zero or negative territory, the effectiveness of additional rate cuts in boosting stock prices becomes limited. In such environments, unconventional monetary policies like quantitative easing may be required to support economic growth and market stability.

Moreover, the impact of rate cuts on stocks can vary across different sectors and individual companies. While some sectors, such as housing and consumer discretionary, may benefit from lower interest rates, others, such as financials and utilities, could face challenges due to compressed margins and increased competition.

In conclusion, the relationship between rate cuts and stock performance is multifaceted and dependent on various factors. While rate cuts can provide a short-term boost to stock prices, their long-term implications are influenced by broader economic conditions, market dynamics, and sector-specific factors. Investors should carefully assess the risks and opportunities associated with rate cuts and consider diversifying their portfolios to mitigate potential market volatility. By staying informed and adopting a prudent investment approach, investors can navigate the complexities of rate cuts and make sound decisions to achieve their financial goals.