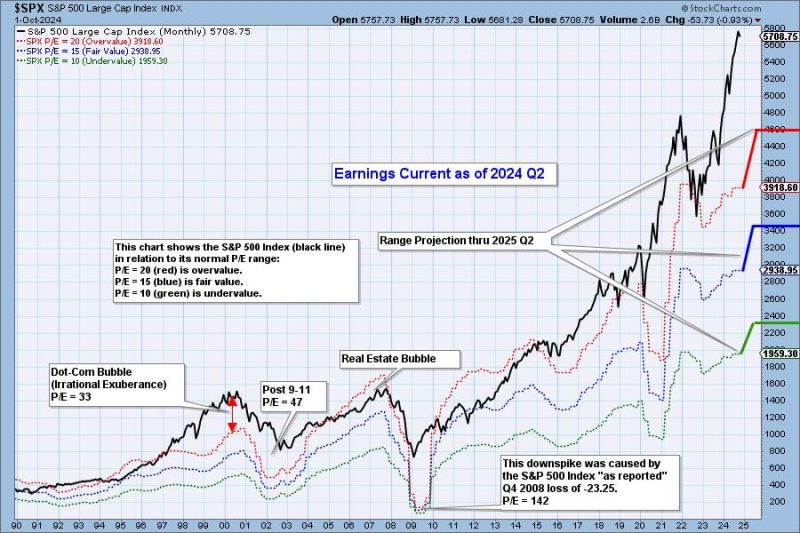

In a recent analysis of the market performance for the second quarter of 2024, the prevailing sentiment appears to be one of continued overvaluation in various sectors. This assessment comes at a critical juncture as investors navigate uncertainties and seek to make informed decisions in an evolving economic landscape.

The technology sector, which has been a mainstay in driving market growth in recent years, continues to face scrutiny over its valuations. Companies in this sector have traditionally commanded high multiples due to their growth potential and innovative capabilities. However, concerns have been raised about the sustainability of these valuations, especially given the challenges of rising competition and regulatory pressures.

Another area of the market that has raised eyebrows is the real estate sector. With property prices soaring in many regions and rental yields under pressure, investors are questioning whether the current valuations are justified. The pandemic-induced shift towards remote work and changing consumer preferences have added layers of complexity to the real estate market dynamics, making it a focal point for many market observers.

Moreover, the healthcare sector, often considered a defensive play in turbulent times, has also seen its valuations come under scrutiny. The sector’s prospects are closely tied to regulatory developments, technological advancements, and healthcare policies, all of which have significant implications for future earnings and growth potential. Investors are closely monitoring these factors to assess the sector’s true value proposition.

Amidst these debates over sector-specific valuations, broader market indicators are also flashing warning signs. The cyclically adjusted price-to-earnings (CAPE) ratio, a popular metric for assessing market valuations, is signaling that stocks may be overvalued relative to historical averages. While this metric is not without its limitations, it serves as a reminder of the importance of maintaining a disciplined approach to investing in potentially frothy markets.

In conclusion, the market’s persistent state of overvaluation in various sectors underscores the importance of conducting thorough due diligence and staying attuned to evolving market dynamics. As investors navigate this challenging terrain, a cautious and selective approach to investment decisions may provide a buffer against potential downside risks. By remaining vigilant, informed, and adaptable, investors can position themselves to weather market fluctuations and capitalize on valuable opportunities as they arise.