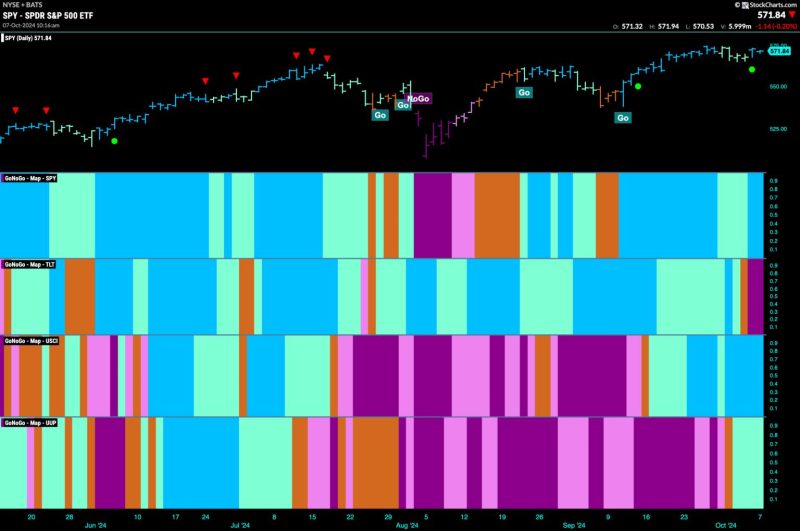

Equities Remain in Go Trend and Lean Into Energy

Identifying trends in the financial markets is a fundamental aspect of successful investing. In recent times, equities have continued to exhibit a strong upward trajectory, known as the Go Trend, indicating favorable market conditions for investors. Moreover, within the equities market, there is a notable lean towards energy-related stocks, presenting potential opportunities for those looking to capitalize on this sector.

The Go Trend, characterized by consistent growth and upward momentum in equities, reflects a positive sentiment among investors. This trend is often associated with economic expansion, bullish market sentiments, and robust corporate performance, all of which contribute to an environment conducive to investment growth. By recognizing and capitalizing on the Go Trend, investors can position themselves strategically to benefit from the prevailing market dynamics.

Energy stocks have emerged as a particularly attractive segment within the equities market. With a growing focus on sustainability, renewable energy sources, and geopolitical factors affecting oil prices, the energy sector presents a diverse range of investment opportunities. Companies involved in renewable energy, such as solar, wind, and hydroelectric power, are witnessing increased investor interest due to their potential for long-term growth and environmental sustainability.

Moreover, traditional energy companies, including oil and gas producers, are also experiencing renewed investor attention given the rising demand for energy worldwide. While these companies face challenges related to environmental concerns and regulatory changes, they continue to play a crucial role in meeting global energy needs. As such, investors who lean into energy-related stocks can benefit from a diversified portfolio that incorporates both traditional and renewable energy assets.

In addition to the inherent growth prospects of energy stocks, investors can also leverage various investment strategies to optimize their returns. By conducting thorough research, staying informed about market trends, and diversifying their portfolios, investors can mitigate risks and enhance their chances of capitalizing on promising opportunities within the energy sector. Furthermore, active portfolio management, prudent risk assessment, and periodic portfolio rebalancing can help investors adapt to changing market conditions and optimize their investment performance over time.

As global energy demands continue to rise, and environmental concerns drive the transition towards renewable energy sources, the energy sector is poised for significant growth and transformation. By aligning their investment strategies with the prevailing Go Trend and leaning into energy-related stocks, investors can position themselves for long-term success and capitalize on the evolving dynamics of the equities market. By staying informed, remaining adaptable, and seizing opportunities as they arise, investors can navigate the complexities of the financial markets and achieve their investment goals in the journey towards financial prosperity.