Investing in Alphafold Stock: A Beginner’s Guide

Understanding AlphaFold’s Potential

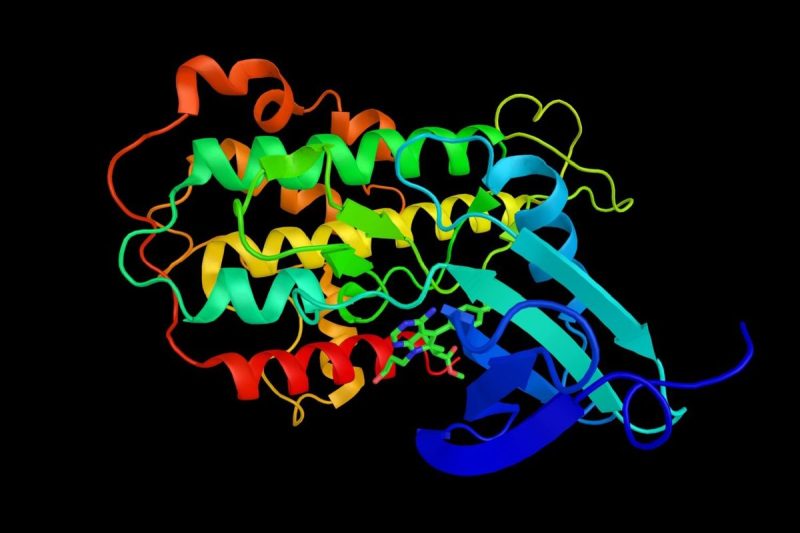

AlphaFold is a prominent name in the sphere of artificial intelligence and biotechnology. The company has gained traction for its groundbreaking work in protein folding, a critical aspect of drug discovery and disease research. AlphaFold’s technology has the potential to revolutionize the healthcare industry by significantly accelerating the development of new drugs and treatments. Investors are eyeing AlphaFold as a lucrative opportunity due to its innovative approach and promising future prospects.

Steps to Invest in AlphaFold Stock

Investing in AlphaFold stock can be an attractive option for individuals seeking exposure to the booming biotechnology sector. Here are some steps to consider when investing in AlphaFold:

1. Conduct Thorough Research: Before diving into the stock market, it is essential to conduct thorough research on AlphaFold, including its business model, financial performance, and market potential. Understanding the company’s trajectory and competitive positioning can help you make informed investment decisions.

2. Evaluate Risk Appetite: Like any investment, investing in AlphaFold stock carries a certain level of risk. It is crucial to evaluate your risk tolerance and investment objectives before allocating capital to the company. Consider factors such as market volatility, industry dynamics, and macroeconomic trends when assessing your risk appetite.

3. Review Financial Data: Analyzing AlphaFold’s financial data, including revenue growth, profit margins, and cash flow, can provide valuable insights into the company’s financial health. Look for consistent revenue growth, strong profitability, and sustainable cash flow generation as indicators of a robust investment opportunity.

4. Monitor Industry Trends: Keeping tabs on industry trends and technological advancements in the biotechnology sector can help you stay ahead of the curve when investing in AlphaFold stock. Stay informed about regulatory developments, market dynamics, and competitor strategies to make informed investment decisions.

5. Consult with Financial Advisors: If you are new to investing or feel uncertain about making investment decisions, consider consulting with financial advisors or investment professionals. They can offer personalized guidance based on your financial goals, risk tolerance, and investment horizon.

6. Diversify Your Portfolio: Investing in AlphaFold stock should be part of a well-diversified investment portfolio. Diversification helps mitigate risk by spreading investments across different asset classes and industries. Consider allocating a portion of your portfolio to AlphaFold while maintaining a balanced mix of assets.

7. Monitor Performance: Once you have invested in AlphaFold stock, monitor the company’s performance regularly. Keep track of key performance indicators, earnings reports, and market news to assess the impact of your investment. Adjust your investment strategy based on changing market conditions and company developments.

In conclusion, investing in AlphaFold stock can be a rewarding opportunity for investors looking to capitalize on the innovative advancements in artificial intelligence and biotechnology. By conducting thorough research, evaluating risk appetite, reviewing financial data, monitoring industry trends, consulting with financial advisors, diversifying your portfolio, and monitoring performance, you can make informed investment decisions and potentially benefit from AlphaFold’s growth prospects in the future.