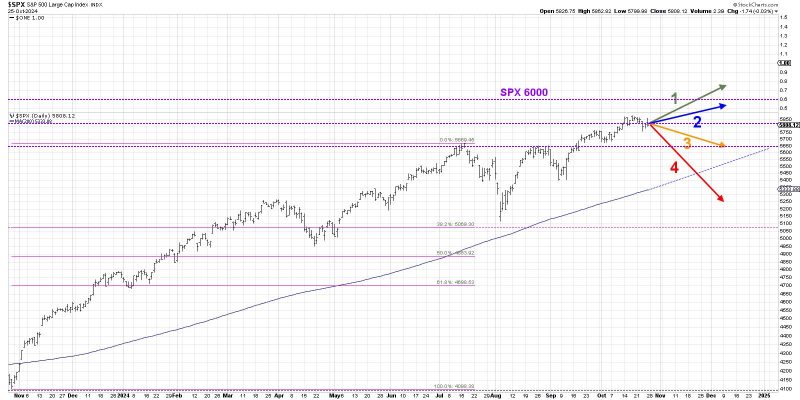

The S&P 500 index is widely regarded as one of the most important benchmarks for the US stock market, comprising the top 500 companies listed on the major exchanges. The index has seen phenomenal growth in recent years, reaching record highs and providing strong returns for investors. However, despite this impressive performance, some experts believe that the S&P 500 won’t break the 6000 mark just yet.

One of the key reasons for this cautious outlook is the current economic climate. While the S&P 500 has shown resilience in the face of various challenges, such as the COVID-19 pandemic and geopolitical tensions, there are still underlying issues that could potentially hinder further growth. For example, concerns about inflation, rising interest rates, and the impact of global supply chain disruptions could weigh on corporate earnings and investor sentiment in the near future.

Additionally, uncertainties surrounding government policies and regulations could also pose risks to the S&P 500’s upward trajectory. The recent changes in leadership and shifts in political priorities could lead to increased volatility in the markets as investors adjust to new policies and initiatives. This uncertainty could dampen investor confidence and slow down the index’s momentum.

Another factor to consider is the valuation of the S&P 500 components. While many companies within the index have posted strong earnings and benefited from favorable market conditions, some stocks may be trading at historically high valuations. This could make it challenging for the index as a whole to achieve significant gains, as lofty valuations may limit further upside potential.

Furthermore, market dynamics and investor behavior play a crucial role in determining the direction of the S&P 500. Despite the overall positive outlook, periods of market corrections and sell-offs cannot be ruled out. Investors may become cautious or risk-averse in response to geopolitical events, economic data releases, or other external factors, leading to increased volatility and downward pressure on the index.

In conclusion, while the S&P 500 has exhibited impressive growth in recent years, there are several factors that suggest the index may not break the 6000 mark in the near future. Economic uncertainties, policy changes, high valuations, and market dynamics could all serve as headwinds to the index’s continued ascent. Investors should remain vigilant and consider these factors when assessing their investment strategies to navigate potential risks and capitalize on opportunities in the ever-evolving stock market.