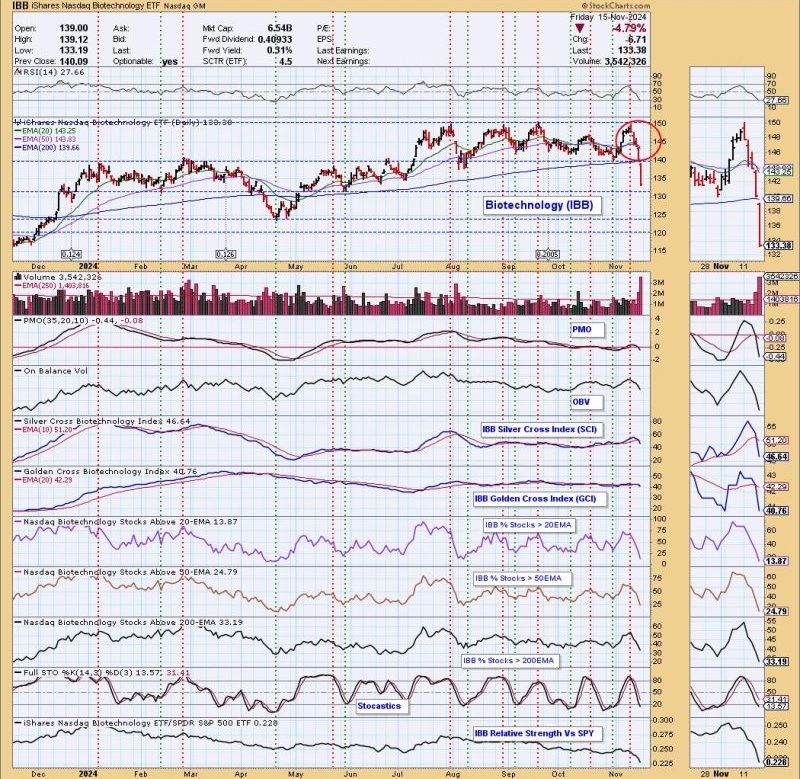

Biotech stocks, usually known for their volatility and potential for rapid growth, are currently facing turbulent times as indicated by the appearance of the dark cross neutral signal on their charts. This ominous development has sent shockwaves through the industry, leading to widespread concern and uncertainty among investors and analysts alike.

The dark cross signal is a technical indicator in the world of stock trading that occurs when a short-term moving average crosses below a long-term moving average. In this case, the signal suggests a change in momentum for biotech stocks, potentially indicating a shift from a bullish to a bearish trend in the market.

One of the key implications of this signal is the increased likelihood of a downturn in the biotech sector. As investors take note of the dark cross forming on the charts of these stocks, they may become more cautious and reluctant to invest further. This hesitancy can create a self-fulfilling prophecy as selling pressure mounts, leading to further declines in stock prices.

While the dark cross signal is not a foolproof indicator of future performance, it serves as a warning sign for investors to closely monitor their positions and exercise caution in such a volatile market environment. Analysts and experts in the field are closely watching how biotech stocks respond to this signal, as it could have far-reaching implications for the industry as a whole.

In addition to the dark cross signal, other factors are contributing to the challenges faced by biotech stocks. Regulatory hurdles, drug development delays, and intense competition are just a few of the issues weighing on the sector. Investors must take all these factors into account when assessing the potential risks and rewards of investing in biotech companies.

Despite the current uncertainties surrounding biotech stocks, some analysts remain cautiously optimistic about the industry’s long-term prospects. The innovative nature of biotechnology, combined with the potential for groundbreaking medical advancements, continues to attract investors seeking high-growth opportunities.

In conclusion, the appearance of the dark cross neutral signal on biotech stocks has raised concerns about the sector’s near-term performance. Investors are advised to tread carefully and do thorough research before making investment decisions in this volatile market environment. While challenges persist, the long-term potential of the biotech industry remains promising for those willing to weather the storm.