Unraveling the Mystery: Why is SMH Outshining SOXX in the World of Semiconductor ETFs?

The semiconductor industry plays a crucial role in the ever-evolving technological landscape, with escalating demands for faster and more efficient devices driving continuous advancements. This reality underscores the significance of semiconductor Exchange-traded funds (ETFs) in modern investment strategies. Two notable ETFs in the sector, the VanEck Vectors Semiconductor ETF (SMH) and the iShares PHLX Semiconductor ETF (SOXX), have been subject to scrutiny recently due to divergent performance trends.

The SMH ETF, designed to track the overall performance of semiconductor companies, offers exposure to a broad range of industry leaders. Despite facing challenges resulting from the U.S.-China trade war and the global supply chain disruptions caused by the COVID-19 pandemic, SMH has demonstrated resilience, remaining relatively stable compared to its counterparts. This outcome can be attributed to several key factors.

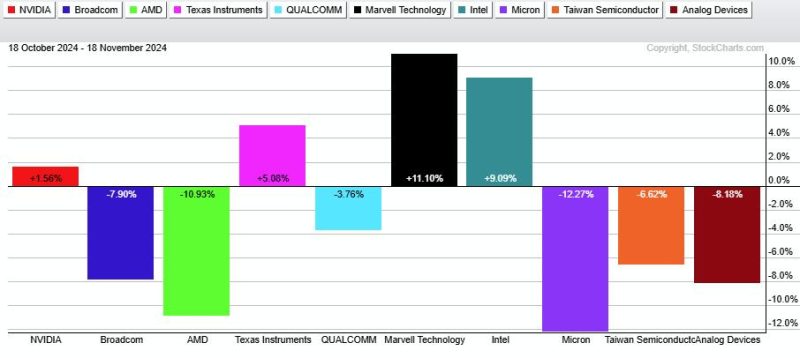

Firstly, the composition of SMH plays a significant role in its performance. The ETF is characterized by a diversified portfolio of holdings, including established industry giants like Intel, Broadcom, and Qualcomm. This diverse lineup provides a cushion against volatility by spreading risk across multiple companies, thus minimizing the impact of adverse developments within any single entity.

Additionally, the stability of SMH can be attributed to the fund’s bold investment strategy, focused on long-term growth prospects. By favoring companies with strong fundamentals and sustainable competitive advantages, SMH is able to weather short-term market fluctuations and position itself favorably for future growth opportunities.

In contrast, the SOXX ETF, while also mirroring the performance of semiconductor companies, has experienced greater volatility in recent times. This heightened instability can be ascribed to several factors unique to SOXX, including its more concentrated portfolio and exposure to specific market sectors.

One notable difference between SMH and SOXX lies in their respective weightings and allocations. SOXX exhibits a more concentrated portfolio, with higher exposure to select semiconductor companies. This concentration amplifies the impact of individual stock movements on the overall fund performance, making SOXX more susceptible to market fluctuations.

Furthermore, the composition of SOXX is influenced by the market sectors it targets. With a focus on semiconductor companies involved in networking and communications, SOXX is more vulnerable to industry-specific challenges and disruptions. Recent developments, such as the newfound importance of 5G technology and the shift towards remote work solutions, have had a greater impact on SOXX due to its sector-specific focus.

In conclusion, the tale of these two semiconductor ETFs sheds light on the nuances of investment strategies within the industry. While SMH’s diversified portfolio and long-term growth orientation have enabled it to maintain stability amidst market uncertainties, SOXX’s concentrated portfolio and sector-specific exposures have led to greater volatility. Ultimately, understanding the intricacies of these ETFs is essential for investors seeking to navigate the dynamic landscape of the semiconductor industry and capitalize on its growth potential.