As a helpful assistant, I’m here to craft a well-structured and unique article based on the provided reference link.

—

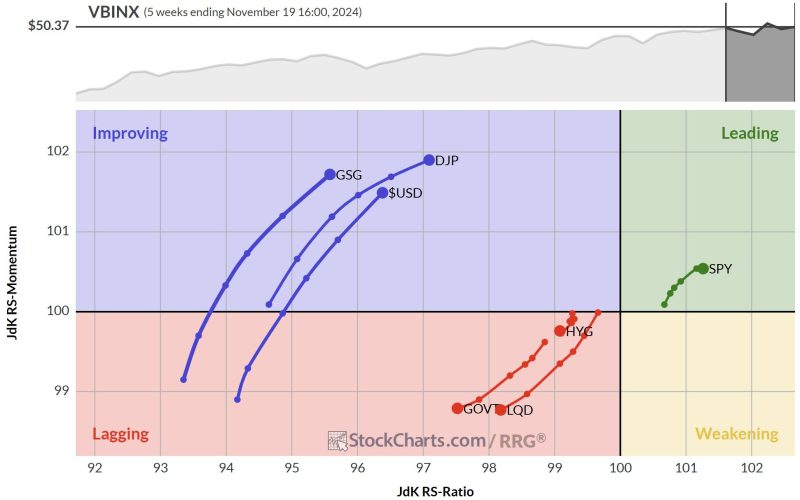

The article on GodzillaNewz discusses whether the USD is setting up for a perfect rally. This speculation comes at a critical time when global currencies are experiencing volatility due to various economic factors. The USD remains a dominant currency in the world economy, influencing trade, investments, and global financial markets.

The article analyses the current economic landscape and its potential impact on the USD. One of the key factors driving this analysis is the comparison between the US Dollar Index (DXY) and the US 10-year Treasury Yield. The relationship between these two indicators can provide insights into the strength and direction of the USD.

Historically, the USD has shown a strong correlation with the US 10-year Treasury Yield. As the yield increases, it tends to attract foreign investment into US assets, leading to a stronger USD. Conversely, a decline in the yield could signal a weakness in the USD.

In recent months, the US 10-year Treasury Yield has been on an upward trend, reflecting expectations of rising inflation and a tightening monetary policy by the Federal Reserve. This development has fueled speculations of a potential USD rally as investors seek higher returns in US assets.

Additionally, the article highlights the impact of geopolitical events and market sentiment on the USD. Uncertainties surrounding global trade tensions, political instability, and the ongoing COVID-19 pandemic can influence investor confidence and drive fluctuations in the currency markets.

Furthermore, the Federal Reserve’s monetary policy decisions play a crucial role in shaping the value of the USD. Any signals of interest rate hikes or changes in the central bank’s stance can have significant implications for the currency’s performance.

In conclusion, while the USD may be setting up for a potential rally based on current market conditions, it is essential to consider the dynamic nature of the global economy and the myriad factors that can influence currency movements. Investors and traders should exercise caution and stay informed about economic developments to navigate the currency markets effectively.

Overall, the analysis presented in the article offers valuable insights into the factors shaping the USD’s outlook and the potential implications for investors and market participants.

—

I hope you find this article summary informative and well-structured. Let me know if you would like any additional information or modifications.