1. Organize Your Goals: Utilizing ChartLists can be a game-changer when it comes to organizing your goals. Start by categorizing your goals based on their urgency or significance. By creating separate lists within your ChartList, you can visually track your progress and ensure that nothing falls through the cracks.

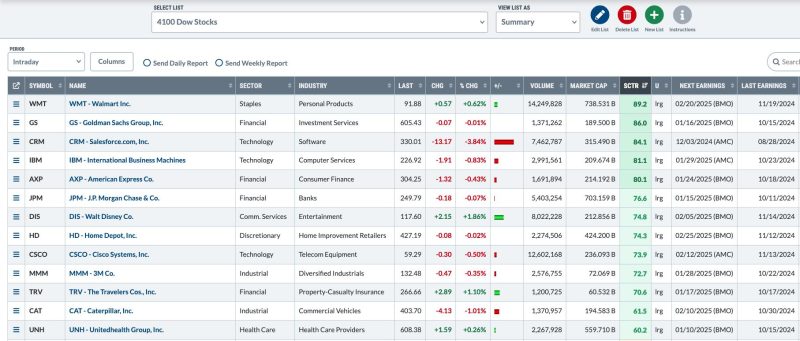

2. Monitor Financial Ventures: Keeping track of your financial ventures is crucial for making informed decisions. By creating a ChartList dedicated to your investments, you can monitor stock performance, track market trends, and make strategic adjustments as needed. With the ability to customize your ChartList based on specific sectors or asset classes, you can stay on top of your financial goals with ease.

3. Analyze Market Trends: ChartLists are an invaluable tool for analyzing market trends and identifying potential opportunities. By creating a dynamic list that includes various technical indicators and chart patterns, you can quickly spot trends and make informed trading decisions. Whether you’re a seasoned trader or a novice investor, utilizing ChartLists can help you stay ahead of the market curve.

4. Track Personal Budget: Managing your personal finances is easier when you have a clear overview of your budget. By creating a ChartList dedicated to tracking your income and expenses, you can visualize your financial health and identify areas where you can cut back or save more. Whether you’re saving for a big purchase or trying to pay off debt, ChartLists can help you stay on track and achieve your financial goals.

5. Stay Informed: ChartLists are not only useful for tracking your own goals and investments but also for staying informed about market trends and news. By following public ChartLists created by financial experts or analysts, you can gain insights into the latest market developments and potential investment opportunities. By leveraging the power of ChartLists in this way, you can stay informed and make informed decisions about your financial future.